Hyperbolic discounting

In behavioral economics, hyperbolic discounting is a time-inconsistent model of discounting.

Given two similar rewards, humans show a preference for one that arrives sooner rather than later. Humans are said to discount the value of the later reward, by a factor that increases with the length of the delay. This process is traditionally modeled in form of exponential discounting, a time-consistent model of discounting. A large number of studies have since demonstrated that the constant discount rate assumed in exponential discounting is systematically being violated.[1] Hyperbolic discounting is a particular mathematical model devised as an improvement over exponential discounting. Hyperbolic discounting has been observed in humans and animals.

In hyperbolic discounting, valuations fall very rapidly for small delay periods, but then fall slowly for longer delay periods. This contrasts with exponential discounting, in which valuation falls by a constant factor per unit delay, regardless of the total length of the delay. The standard experiment used to reveal a test subject's hyperbolic discounting curve is to compare short-term preferences with long-term preferences. For instance: "Would you prefer a dollar today or three dollars tomorrow?" or "Would you prefer a dollar in one year or three dollars in one year and one day?" For certain range of offerings, a significant fraction of subjects will take the lesser amount today, but will gladly wait one extra day in a year in order to receive the higher amount instead.[2] Individuals with such preferences are described as "present-biased".

Individuals using hyperbolic discounting reveal a strong tendency to make choices that are inconsistent over time—they make choices today that their future self would prefer not to make, despite using the same reasoning. This dynamic inconsistency happens because the value of future rewards is much lower under hyperbolic discounting than under exponential discounting.[3]

Contents |

Observations

The phenomenon of hyperbolic discounting is implicit in Richard Herrnstein's "matching law," the discovery that most subjects allocate their time or effort between two non-exclusive, ongoing sources of reward (concurrent variable interval schedules) in direct proportion to the rate and size of rewards from the two sources, and in inverse proportion to their delays. That is, subjects' choices "match" these parameters.

After the report of this effect in the case of delay,[4] George Ainslie pointed out that in a single choice between a larger, later and a smaller, sooner reward, inverse proportionality to delay would be described by a plot of value by delay that had a hyperbolic shape, and that this shape should produce a reversal of preference from the larger, later to the smaller, sooner reward for no other reason but that the delays to the two rewards got shorter. He demonstrated the predicted reversal in pigeons.[5]

A large number of subsequent experiments have confirmed that spontaneous preferences by both human and nonhuman subjects follow a hyperbolic curve rather than the conventional, "exponential" curve that would produce consistent choice over time.[6][7] For instance, when offered the choice between $50 now and $100 a year from now, many people will choose the immediate $50. However, given the choice between $50 in five years or $100 in six years almost everyone will choose $100 in six years, even though that is the same choice seen at five years' greater distance.

Hyperbolic discounting has also been found to relate to real-world examples of self control. Indeed, a variety of studies have used measures of hyperbolic discounting to find that drug-dependent individuals discount delayed consequences more than matched nondependent controls, suggesting that extreme delay discounting is a fundamental behavioral process in drug dependence.[8][9][10] Some evidence suggests pathological gamblers also discount delayed outcomes at higher rates than matched controls.[11] Whether high rates of hyperbolic discounting precede addictions or vice-versa is currently unknown, although some studies have reported that high-rate discounting rats are more likely to consume alcohol[12] and cocaine[13] than lower-rate discounters. Likewise, some have suggested that high-rate hyperbolic discounting makes unpredictable (gambling) outcomes more satisfying.[14]

The degree of discounting is vitally important in describing hyperbolic discounting, especially in the discounting of specific rewards such as money. The discounting of monetary rewards varies across age groups due to the varying discount rate.[6] The rate depends on a variety of factors, including the species being observed, age, experience, and the amount of time needed to consume the reward.[15][16]

Mathematical model

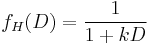

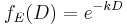

Hyperbolic discounting is mathematically described as:

where f(D) is the discount factor that multiplies the value of the reward, D is the delay in the reward, and k is a parameter governing the degree of discounting. This is compared with the formula for exponential discounting:

Simple derivation

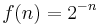

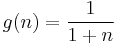

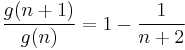

If  is an exponential discounting function and

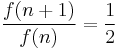

is an exponential discounting function and  a hyperbolic function (with n the amount of weeks), then the exponential discounting a week later from "now" (n=0) is

a hyperbolic function (with n the amount of weeks), then the exponential discounting a week later from "now" (n=0) is  , and the exponential discounting a week from week n is

, and the exponential discounting a week from week n is  , which means they are the same. For g(n),

, which means they are the same. For g(n),  , which is the same as for f, while

, which is the same as for f, while  . From this one can see that the two types of discounting are the same "now", but when n is much greater than 1, for instance 52 (one year),

. From this one can see that the two types of discounting are the same "now", but when n is much greater than 1, for instance 52 (one year),  will tend to go to 1, so that the hyperbolic discounting of a week in the far future is virtually zero, while the exponential is still 1/2.

will tend to go to 1, so that the hyperbolic discounting of a week in the far future is virtually zero, while the exponential is still 1/2.

Quasi-hyperbolic approximation

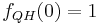

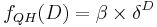

The "quasi-hyperbolic" discount function, proposed by Laibson (1997),[3] approximates the hyperbolic discount function above in discrete time by

, and

, and ,

,

where β and δ are constants between 0 and 1; and again D is the delay in the reward, and f(D) is the discount factor. The condition f(0) = 1 is stating that rewards taken at the present time are not discounted.

Quasi-hyperbolic time preferences are also referred to as "beta-delta" preferences. They retain much of the analytical tractability of exponential discounting while capturing the key qualitative feature of discounting with true hyperbolas.

Explanations

Uncertain risks

Notice that whether discounting future gains is rational or not—and at what rate such gains should be discounted—depends greatly on circumstances. Many examples exist in the financial world, for example, where it is reasonable to assume that there is an implicit risk that the reward will not be available at the future date, and furthermore that this risk increases with time. Consider: Paying $50 for your dinner today or delaying payment for sixty years but paying $100,000. In this case the restaurateur would be reasonable to discount the promised future value as there is significant risk that it might not be paid (possibly due to your death, his death, etc.).

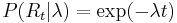

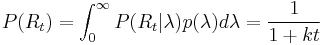

Uncertainty of this type can be quantified with Bayesian analysis.[17] For example, suppose that the probability for the reward to be available after time t is, for known hazard rate λ

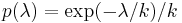

but the rate is unknown to the decision maker. If the prior probability distribution of λ is

then, the decision maker will expect that the probability of the reward after time t is

which is exactly the hyperbolic discount rate. Similar conclusions can be obtained from other plausible distributions for λ.[17]

Present self vs. future self

Instant gratification pleases the present self while delayed rewards benefit the future self. If time-dependent decisions are viewed as competition between the present self and a future self, many apparent paradoxical decisions make much more sense.

Applications

More recently these observations about discount functions have been used to study saving for retirement, borrowing on credit cards, and procrastination. However, hyperbolic discounting has been most frequently used to explain addiction.

See also

References

- ^ Frederick, Shane; Loewenstein, George; O'Donoghue, Ted (2002). "Time Discounting and Time Preference: A Critical Review". Journal of Economic Literature 40 (2): 351–401. doi:10.1257/002205102320161311.

- ^ Thaler, R. H. (1981). "Some Empirical Evidence on Dynamic Inconsistency". Economic Letters 8 (3): 201–207. doi:10.1016/0165-1765(81)90067-7.

- ^ a b Laibson, David (1997). "Golden Eggs and Hyperbolic Discounting". Quarterly Journal of Economics 112 (2): 443–477. doi:10.1162/003355397555253.

- ^ Chung, S. H.; Herrnstein, R. J. (1967). "Choice and delay of Reinforcement". Journal of the Experimental Analysis of Behavior 10 (1): 67–74. doi:10.1901/jeab.1967.10-67.

- ^ Ainslie, G. W. (1974). "Impulse control in pigeons". Journal of the Experimental Analysis of Behavior 21 (3): 485–489. doi:10.1901/jeab.1974.21-485.

- ^ a b Green, L.; Fry, A. F.; Myerson, J. (1994). "Discounting of delayed rewards: A life span comparison". Psychological Science 5 (1): 33–36. doi:10.1111/j.1467-9280.1994.tb00610.x.

- ^ Kirby, K. N. (1997). "Bidding on the future: Evidence against normative discounting of delayed rewards". Journal of Experimental Psychology: General 126 (1): 54–70. doi:10.1037/0096-3445.126.1.54.

- ^ Bickel, W. K.; Johnson, M. W. (2003). "Delay discounting: A fundamental behavioral process of drug dependence". In Loewenstein, G.; Read, D.; Baumeister, R. F.. Time and Decision. New York: Russell Sage Foundation. ISBN 0871545497.

- ^ Madden, G. J.; Petry, N. M.; Bickel, W. K.; Badger, G. J. (1997). "Impulsive and self-control choices in opiate-dependent patients and non-drug-using control participants: Drug and monetary rewards". Experimental and Clinical Psychopharmacology 5: 256–262. PMID 9260073.

- ^ Vuchinich, R. E.; Simpson, C. A. (1998). "Hyperbolic temporal discounting in social drinkers and problem drinkers". Experimental and Clinical Psychopharmacology 6 (3): 292–305. doi:10.1037/1064-1297.6.3.292.

- ^ Petry, N. M.; Casarella, T. (1999). "Excessive discounting of delayed rewards in substance abusers with gambling problems". Drug and Alcohol Dependence 56 (1): 25–32. doi:10.1016/S0376-8716(99)00010-1.

- ^ Poulos, C. X.; Le, A. D.; Parker, J. L. (1995). "Impulsivity predicts individual susceptibility to high levels of alcohol self administration". Behavioral Pharmacology 6 (8): 810–814. doi:10.1097/00008877-199512000-00006.

- ^ Perry, J. L.; Larson, E. B.; German, J. P.; Madden, G. J.; Carroll, M. E. (2005). "Impulsivity (delay discounting) as a predictor of acquisition of i.v. cocaine self-administration in female rats". Psychopharmacology 178 (2–3): 193–201. doi:10.1007/s00213-004-1994-4. PMID 15338104.

- ^ Madden, G. J.; Ewan, E. E.; Lagorio, C. H. (2007). "Toward an animal model of gambling: Delay discounting and the allure of unpredictable outcomes". Journal of Gambling Studies 23 (1): 63–83. doi:10.1007/s10899-006-9041-5.

- ^ Loewenstein, G.; Prelec, D. (1992). Choices Over Time. New York: Russell Sage Foundation. ISBN 0871545586.

- ^ Raineri, A.; Rachlin, H. (1993). "The effect of temporal constraints on the value of money and other commodities". Journal of Behavioral Decision-Making 6 (2): 77–94. doi:10.1002/bdm.3960060202.

- ^ a b Sozou, P. D. (1998). "On hyperbolic discounting and uncertain hazard rates". Proceedings of the Royal Society B Biological Sciences 265 (1409): 2015. doi:10.1098/rspb.1998.0534.

Further reading

- Ainslie, G. W. (1975). "Specious reward: A behavioral theory of impulsiveness and impulsive control". Psychological Bulletin 82 (4): 463–496. doi:10.1037/h0076860. PMID 1099599.

- Ainslie, G. (1992). Picoeconomics: The Strategic Interaction of Successive Motivational States Within the Person. Cambridge: Cambridge University Press.

- Ainslie, G. (2001). Breakdown of Will. Cambridge: Cambridge University Press. ISBN 978-0-521-59694-7.

- Rachlin, H. (2000). The Science of Self-Control. Cambridge; London: Harvard University Press.